AEM (Anhaltische Elektromotorenwerk), an electric motor manufacturer located in Dessau, Saxony-Anhalt, Germany, a company with nearly 70 years of history in motor manufacturing, failed to find investors after going bankrupt and ultimately declared complete closure.

an electric motor manufacturer from Dessau, Saxony-Anhalt, Germany, without the support of investors, things could no longer continue. Despite significant efforts, attempts to find investors for this motor manufacturer failed. The company filed for bankruptcy in January of this year, and its approximately 50 employees have all been laid off.

.jpg)

II. A Long History

AEM has a very long history, consistently ranking as a leading supplier of specialized motors for industrial applications. Its predecessor, BAMAG, founded in 1872, developed into a leading machine tool manufacturer. After World War II, the company was broken up and nationalized in 1946, giving rise to the Dessau Motor Factory. From 1948, the company began producing motors, and later synchronous generators. After German reunification, the factory was incorporated into the VEM Group in 1990. In 1993, four former employees founded AEM GmbH, and a new factory was built by 1995. Through targeted investments, modernized production, and the development of new products, AEM has transformed itself into a specialized manufacturer of specialized motors.

.jpg)

III. Technological Leadership

AEM is a medium-sized family business with 70 years of experience in motor manufacturing. With approximately 150 employees, AEM has become one of the world's most successful manufacturers of three-phase AC motors and three-phase AC generators for specialized machinery. It has reportedly achieved tremendous growth over the past 20 years, with turnover more than doubling and exports increasing by 60%. AEM focuses on developing and producing generators for hydraulic and marine applications, as well as motors for mining machinery, conveyors, construction machinery, and test benches, according to customer requirements.

IV. Product Excellence

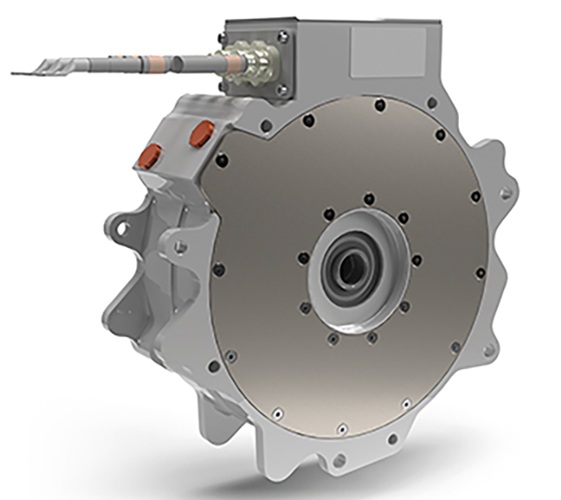

AEM's product line mainly includes 150 to 4,200 kVA three-phase synchronous generators and 110 to 3,500 kW medium and low voltage three-phase asynchronous motors. AEM synchronous generators reportedly feature a brushless electronic control design and are equipped with an integrated AEM voltage regulator (AVR), meeting the highest requirements for technical parameters, operational performance, reliability, and ease of maintenance. Its products are used globally for shipboard power supplies in marine, hydroelectric power plants, combined heat and power systems, emergency power systems, and test field power supply.

AEM synchronous generators are characterized by high reliability and long service life, ease of service, good efficiency behavior, low power-to-weight ratio, and high voltage stability. AEM medium and low voltage three-phase asynchronous motors offer protection ratings up to IP 68, cooling types up to IC 86W7, speeds up to 3,600 rpm, and heat resistance ratings of F and H.

V. Reasons for Closure

AEM faced immense operational pressure in recent years. Declining demand, rising energy and production costs, and stagnant investment were the reasons for its closure. For the Dessau-Roßlau region, the factory closure not only meant the loss of a long-standing employer but also the loss of expertise in electrical engineering. VI. Industry Implications AEM's closure reflects the common challenges faced by the global electrical engineering industry.

According to an analysis in the MIH bi-monthly, the global electric vehicle market is presenting a new landscape under a multi-axis structure. China, relying on its massive domestic demand and policy system, has become the fastest-growing stage for the mass production of new technologies; Europe, on the other hand, is driving high efficiency and low rare-earth content through stringent regulations. The electric drive revolution is propelling the parallel development of axial flux motors and rare-earth-free technologies.

Axial flux motors, with their extreme power density, have become the choice for high-performance vehicles, while rare-earth-free motors have become a mainstream strategic direction for OEMs due to the risks associated with the rare-earth supply chain. Global competition has shifted to an era of system synergy, with automakers seeking comprehensive, collaborative solutions encompassing motors, drive control, thermal design, and software algorithms.

Suppliers must upgrade from module suppliers to system integration partners to survive. The collapse of AEM is a microcosm of this era. As the global motor industry moves towards axial flux, rare-earth-free technology, and system integration, those companies unable to adapt, no matter how illustrious their history, will inevitably be eliminated.